Whether you’re looking to buy a new home, purchase a car or finance a business venture, your credit will play a key role in whether or not you obtain the loan you need.

Before applying for any loan, you should know all three of your credit scores. Yes – all three.

With Credit Check Total, you will have a complete picture of your credit and your financial situation.

Why Do You Need All Three Scores?

Why do you need to see all three scores? Aren’t they all the same? No.

When you apply for a loan, there’s a good chance that the lender will look at your credit reports and scores from all three bureaus: Equifax, TransUnion and Experian. Each report and score will be different because different information is reported to different bureaus. Your auto lender may report to Experian and Equifax, but not TransUnion. That means TransUnion has slightly different information that may affect a lender’s decision.

If one score isn’t up to par, you may not be approved for the loan. Had you known all three scores, you could have improved them to make sure that the loan was approved.

Lenders have their own ideas of what constitutes as a “good” credit score. Knowing all of your scores and reports will at least give you an idea of whether you fit into the “good” category.

Generally speaking, scores greater than 720 are considered “great” and will help you qualify for a loan with a low interest rate. The greater your score, the better your chances of being approved and with a lower rate.

Two other reasons to check all three credit reports and scores: identity theft and errors.

Credit report errors are common.

In fact, 20% of all credit reports have some kind of error.

Ultimately, it’s up to you to report these errors and have them corrected. One report may have an error that’s damaging your overall credit history. If you don’t check all three, you may never find the error.

Errors can cause you to have higher interest rates, or even prevent you from getting the credit card or loan you need.

Accuracy is important. Payment history accounts for 35% of your credit score. If your payments aren’t being reported accurately, it can hurt your credit score for years to come.

Identity theft is also on the rise, and yet another reason to check all three reports and scores. If something suspicious appears on your report, you can take action right away. In 2014, 70 million Americans reported stolen data.

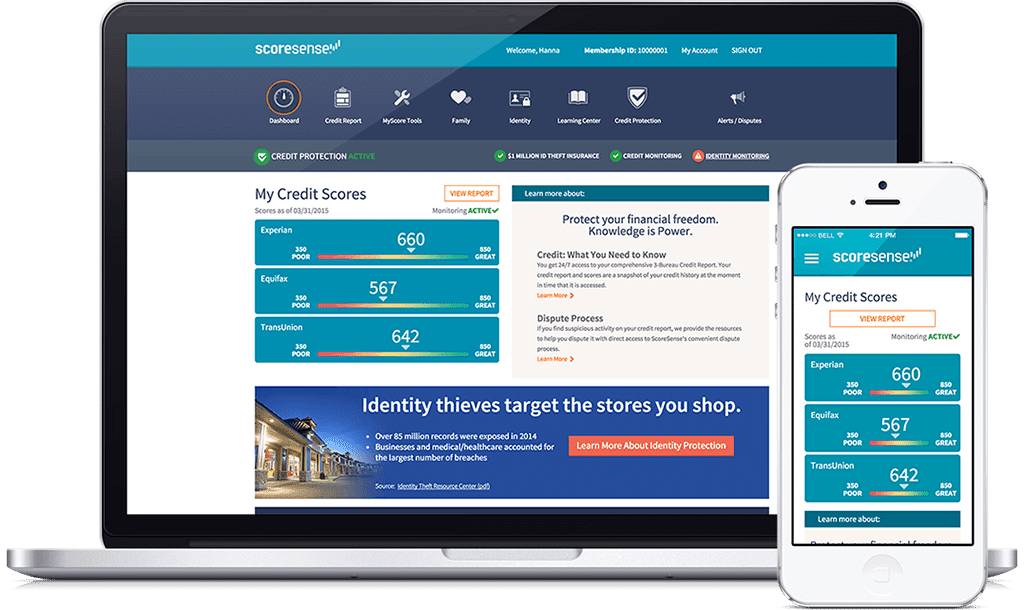

Powered by ScoreSense, this complete credit check service allows you to see all of your scores, so you have a complete look at your financial state.

What is a Credit Check Total?

The program is exactly what it sounds like – a complete credit check. You get to see all three scores and reports through one simple service.

With a credit check total report, you can:

- See your scores and reports from Experian, TransUnion and Equifax whenever you want – 24/7.

- Be alerted to changes in your score.

- Gain access to tools that help you understand your scores.

- Protect your credit and identity, with identity theft insurance

- Find and correct errors that may be damaging your credit.

That’s right – you can check your score whenever you want. Everyone is entitled to one free report each year from each bureau, but do you really want to wait a whole year to check your score again?

ScoreSense also helps you make sense of your score, by categorizing it into one of four categories:

- Poor: 599 and below

- Fair: 600-679

- Good: 680-759

- Great: 760-850

Being alerted to changes in your credit score will also help you tackle identity theft issues early on before they can do life-long, permanent damage to your credit.

How Does the Service Work?

After signing up for an account, you will have access to the dashboard. The dashboard gives access to all of the service’s features. And if you’re not sure what a feature does, the “Learn More” links and “?” buttons will provide you with more information.

Within 24 hours of signing up, you should also receive a welcome email that contains important information about your membership.

What Does Credit Check Total Include?

With a holistic credit score service, you can take advantage of a number of features, including:

All 3 Credit Scores and Reports

All 3 Credit Scores and Reports

Gain access to all three credit scores and reports, so you know how your credit will look to potential insurers, lenders, landlords and even employers.

You can check your score as many times as you want, and you don’t have to worry about it impacting your credit score.

Learning Center

Learning Center

You’ll also have access to their Credit Learning Center, which will help you get on the right track to keeping your credit healthy.

This educational center provides tips on how to maintain a good credit score and how to avoid identity theft.

Dispute Center

Dispute Center

As a user, you also gain valuable access to the Dispute Center. The Dispute Center allows you to clear your report of fraud and errors that may be harming your score. ScoreSense provides guidance on how to report errors and fraud.

Identity Theft Insurance

Identity Theft Insurance

Along with all of the valuable tools listed above, you’ll also gain $1 million in identity theft insurance to protect your name from identity thieves.

Identity theft insurance will protect you in case someone steals your identity and attempts to damage your credit.

Credit Tools

Credit Check Total also offers helpful tools to help you keep tabs on your credit.

The alert system will let you know if something suspicious pops up on your credit, like new account openings or delinquent payments.

ScoreTracker allows you to track the progress of your credit score from month to month. If you have goals for your score, the tracker will help you reach them. The program can help you keep track of your score from all three bureaus for up to two years.

Additionally, ScoreCast can help you understand what your score will look like in certain scenarios. What happens if you don’t pay the mortgage on time, or if you pay off a loan? What about if you take out a new car loan? ScoreCast will give you an estimated look at what your score might look like in certain scenarios. This information can help you in your decision-making process, so you make smarter choices that won’t hurt your credit score.

ScoreCast allows you to simulate as many scores as you want every month. Don’t worry – the simulation will have no impact on your actual score.

Improve Your Score & Protect Your Identity With Credit Check Total

With this complete service, you take a proactive approach to protecting your identity and improving your credit score. And you’ll gain access to tools that will help you preserve your credit for years to come. From monitoring to identity protection and everything in between, this is the perfect service to help you get a clear picture of your financial situation.

Don’t wait until it’s too late to check your score and keep tabs on your credit history. Find out now whether you need to improve your score, report errors or take action against potential identity theft. It’s a small price to pay to preserve or improve your financial future.