Use Your Utility Bills to Increase Your Credit Score Instantly With Experian Boost

Experian Boost is offered one of the major credit bureaus. When it comes to getting a loan, financing or even renting an apartment, your credit score matters.

If you have a low credit score, you’ll have:

- Difficulty obtaining financing

- To pay higher interest rates

- To find ways to increase your score

Paying your credit cards and loans on time is key, but how about all of the other bills that you pay? Most credit bureaus do not include your electric or utility bills when calculating your credit score.

Why? Utility companies do not report the payments to the credit bureau.

In essence, you’re not getting “credit” for paying all of these bills on time.

This is where Experian Boost comes in.

What Is Experian Boost?

Experian wants you to have the credit that you deserve, and the company does this by offering Experian Boost to instantly raise your credit score for free.

How Does Experian Boost Work?

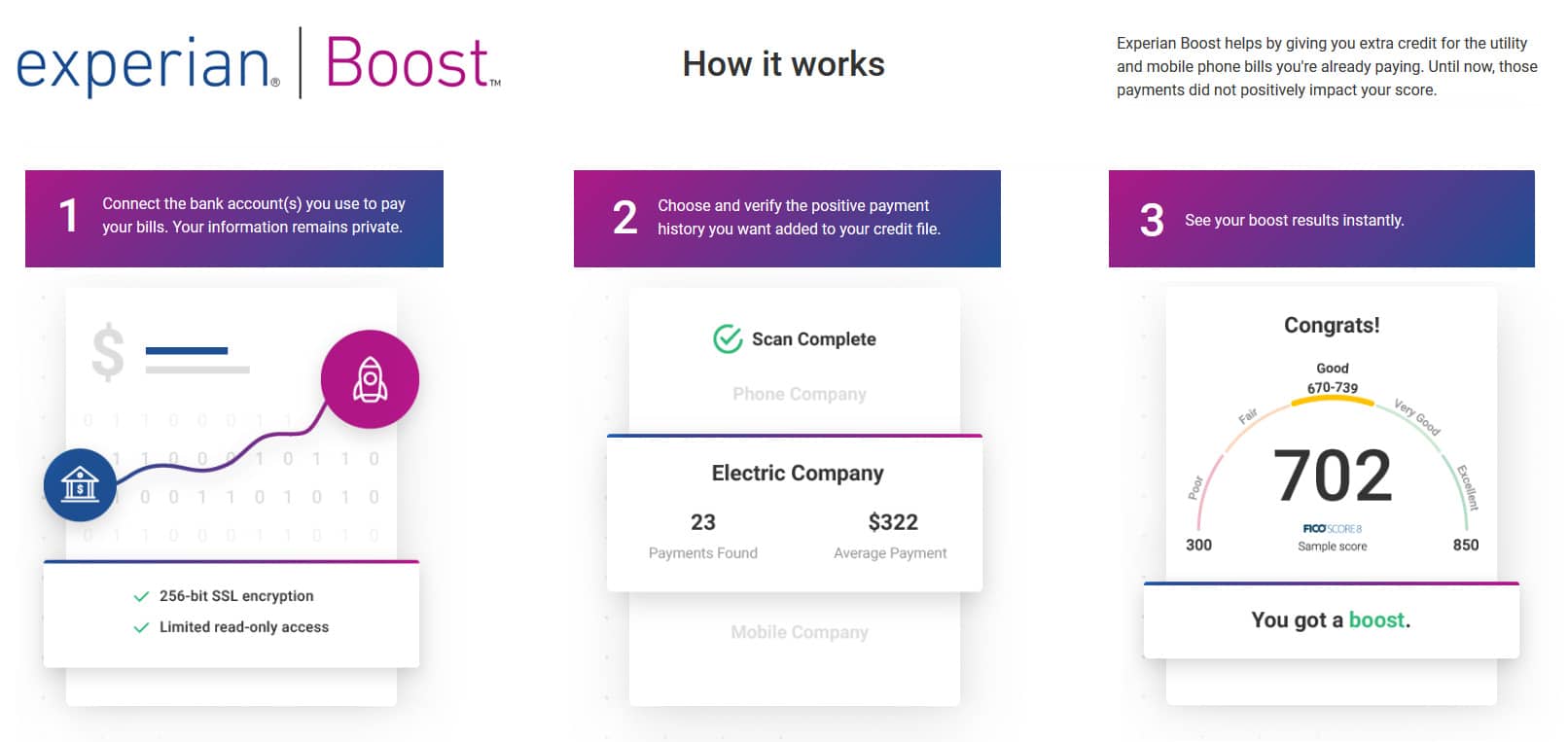

Experian connects to your bank account, or multiple accounts, that you already use to pay your bills. The company connects to these accounts to be able to view and verify your payment history.

The bills you’re already paying will start counting towards your credit history.

These bills include:

- Electric

- Gas

- Cable

- Mobile phone

- Phone

You’ll add your bank account to the system, choose and verify your payment history for the services that you want, and the rest is hands-off.

Experian will do all of the hard work, and you’ll receive an immediate boost on your credit score as a result. You obviously want to make sure that all of these bills are going to have a positive impact, so you need to be current on all of them.

Since it’s a free service, you have nothing to lose.

Anyone with poor or limited credit will be able to establish credit using Experian Boost.

You’ll be able to also enjoy:

- Free credit score tracking

- Free credit score factors

It’s a way to strengthen your credit, especially for anyone that has poor credit and would like to enjoy lower interest rates or more borrowing options.

When you attach your bank account(s), you’ll be able to count all of the utility bills that you want on your Experian credit report. Every time payments are made, this is a benefit to your score and will add to your positive payment history.

Experian claims that their Boost product will work with you, only adding positive payment history to your account.

If you missed a payment on your mobile bill two months ago, the missed payment will not have a negative impact on your score. The system is able to detect only positive payments, so it’s a great way to boost your score even if you have missed a payment or two in the past.

Experian is able to adjust your FICO score instantly, so you’ll be able to see the difference the utilities that you pay for have on your credit immediately.

How Much Will Your Scores Increase?

Experian has done their own internal testing, and the company found that 2 out of 3 scores rose, or roughly 66% of scores.

Remember, that other person’s score was not negatively impacted. If that person’s score was 712 before using Experian Boost, it will still be 712 because negative payment history is not accounted for in the program.

Those that did have their credit score improve were able to enjoy a 10-point increase on average.

When a lender requests your credit score and views your credit history, they will only be able to see the addition of your utility bills if the report was pulled using one of the following:

- FICO 8

- FICO 9

- VantageScore 3 / 4

The lender will need to pull your Experian score specifically, but since Experian is one of the “big three,” it’s very likely that the score will be pulled.

If a lender only pulls scores from the following, Experian Boost will not help:

- Transunion

- Equifax

But every little point can help your credit score and may be able to add to your loan eligibility. Experian’s own study found that:

- 75% of people that have a credit score that’s below 680 were able to improve their credit score.

- 14% of people that have a credit score of 579 or less had their credit score improve to between 620 and 679.

- 5% – 15% of people have their credit improve enough to move them into a better score category.

- 10% of people that had insufficient credit had their credit improve to sufficient levels.

And all of these benefits were for free.

Every lender can use the data that they receive differently. Lenders may have their own scoring model, so your utility payments may have a drastic difference on your overall borrowing ability.

If you’re a young adult trying to increase your credit or a consumer with subprime credit, Experian Boost can help.

Is It Safe?

Yes. Experian is one of the top three credit bureaus. The company is a trusted company, and since Boost can only help your credit, it makes sense to try it. You have absolutely nothing to lose. Not a dime.

Your credit score cannot go down either.

Experian Boost Reviews

Reviews are starting to come in for the program, and they’re very positive. Since there’s no risk of your score going down, there really is no reason not to try this program. The people that have reviewed Experian Boost have a lot of good things to say:

- Boosted my score from 695 to 710

- Boosted my score by 9 points

But there are some downsides, too. A lot of people are reporting that they were able to increase their credit score initial and then it dropped back down to the previous level. This issue seems to be ironed out now, but it happened when the program was first available.

It’s not the end of the world because it’s not going to hurt your credit overall. It’s just an initial hiccup of the program.

A lot of people are not happy with Experian asking for their bank account information. The company needs this information to be able to verify your payment history. While it may seem overreaching, it is the only way for the company to be able to verify your information properly.

Experian Boost is a great option if you have bad credit or you have little-to-no credit and want to begin establishing it. Based off of the company’s own internal data, if you have no credit score or a lower credit score, you may be able to increase your credit score much more than the 10-point average.