Identity theft is on the rise across the world. In the U.S. alone, 47% of Americans were the victims of identity theft in 2020, and it cost them $712.4 billion. As a result, monitoring your identity is becoming increasingly important, and Experian IdentityWorks program can help you do just that.

What is Experian IdentityWorks?

Experian IdentityWorks is an identity theft monitoring service offered by the credit bureau Experian.

The IdentityWorks program provides:

- Identity theft monitoring

- Dark web surveillance

- Credit monitoring and FICO scores from the 3 major bureaus

- Experian CreditLock for easy locking and unlocking of your credit file

Like other identity theft programs, this one has two tiers of service: Plus and Premium.

IdentityWorks Plus

The Plus tier is the basic plan offered by IdentityWorks. It includes:

- Up to $500,000 in identity theft insurance

- Dark web surveillance

- Lost wallet assistance

- Fraud resolution specialist that’s based in the U.S.

- Identity theft monitoring that includes address change verification and Social Security number monitoring

Additionally, this plan includes:

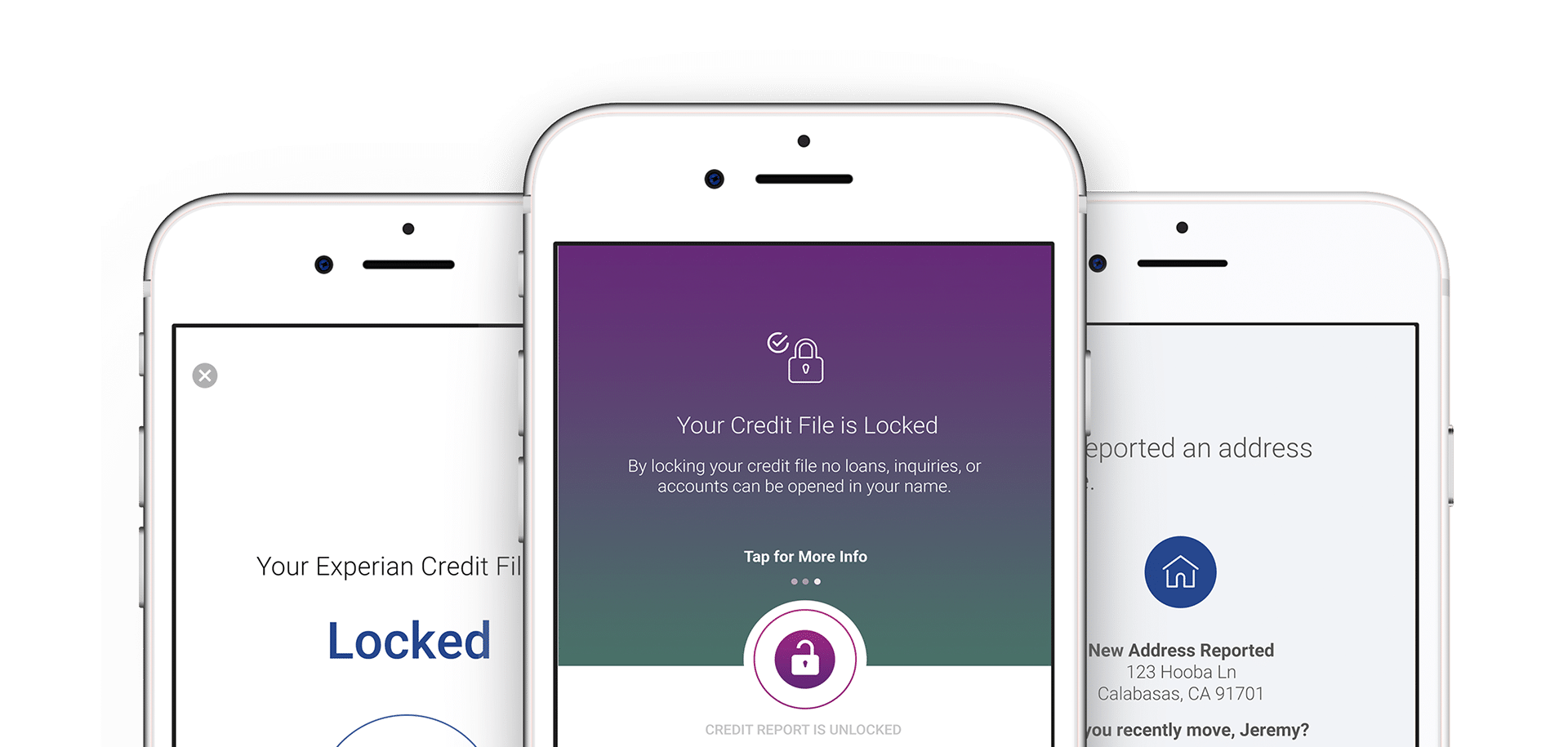

Experian CreditLock

Experian CreditLock provides real-time alerts on credit inquiries and the ability to lock and unlock your credit file

Credit Bureau Monitoring and Scores

With the Plus plan, you get credit monitoring with Experian only. You’ll receive alerts for:

- New accounts

- New credit inquiries

- Credit utilization

- Large account balance changes

- Dormant accounts

- Positive activity

- FICO Score alerts

You’ll also get daily access to your FICO scores based on Experian data as well as:

- Score tracking

- FICO Score Simulator

The FICO Score simulator is a helpful tool that lets you see what may happen to your score if you take different actions. For example, you can see how much your score may increase if you pay off a credit card.

Simulators are a great option if you want to:

- Increase your credit score to get the best rate on a mortgage or qualify for a mortgage

- Refinance or take out a loan and wish to receive the best rates by improving your credit

- Make smart decisions when paying off debt

The FICO score simulator is an excellent option for anyone with less than perfect credit and wants to find ways to boost their score.

For basic identity theft monitoring, the Plus plan provides the most important services at an affordable price.

IdentityWorks Premium

The Premium tier includes additional services for more complete monitoring of your identity. With this tier, you receive the following:

- Up to $1 million in identity theft insurance

- Dark web surveillance

- Lost wallet assistance

- Fraud resolution specialist based in the U.S.

The identity theft monitoring and alerts are more comprehensive with this tier compared to the Plus plan. It includes:

- Social Security number monitoring

- Financial account activity monitoring

- Address change verification

- Court records

- Identity validation alerts

- Payday loan monitoring

- File-sharing network monitoring

- Social network monitoring

- Sex offender registry

Like with the Plus tier, you also receive the following:

Experian CreditLock

The Premium program also provides real-time alerts of credit inquiries and gives you the ability to lock and unlock your Experian credit file.

Credit Monitoring and Scores

With the Premium tier, you receive more advanced credit monitoring and alerts for all three major credit bureaus: Experian, TransUnion and Equifax.

Monitoring includes:

- New accounts

- New inquiries

- Credit utilization

- Large account balance changes

- Dormant accounts

- Positive activity

- FICO Score alerts

As for your credit scores, with IdentityWorks Premium, you get:

- All 3 FICO scores on a quarterly basis

- Daily access to your Experian FICO Score

- FICO Score Simulator

- Score tracking

Obtaining all three credit reports is important because different reports may have different information listed.

How the Program Works

Experian makes it quick and easy to sign up for the IdentityWorks program. First, you’ll need to choose how many people will be covered and whether you want a Plus or Premium account.

From here, Experian will ask for your personal information, including your:

- Name

- Address

- Email address

- Phone number

- Social Security number

- Birth date

You’ll also need to create a username and password, and provide Experian with your payment information.

Once you’ve created an account, you can log into your dashboard. IdentityWorks has a clean, intuitive interface that makes it very user-friendly.

How Much is IdentityWorks?

Experian’s IdentityWorks is a robust identity monitoring program, but it still comes at an affordable price. The credit bureau also offers options for individuals and families, so you can choose a plan that works best for your lifestyle and needs.

No matter which plan you choose and how many people you want to protect, your IdentityWorks plan will come with a 30-day free trial. The trial gives you an opportunity to see whether the program is worthwhile and meets your expectations.

Here’s a breakdown of the plan’s pricing:

- For a Single Adult: $9.99/month for Plus; $19.99/month for Premium

- One Adult and Up to 10 Children: $14.99/month for Plus; $24.99/month for Premium

- Two Adults and Up to 10 Children: $19.99/month for Plus; $29.99/month for Premium

Experian gives you the option of paying monthly or being billed annually and saving 17%.

It’s hard to put a value on your identity and peace of mind that your identity is being monitored for suspicious activity. But Experian manages to make it affordable and attainable for most families with their IdentityWorks program.

Because the program is offered by Experian, one of the three major credit bureaus, it’s safe to say that they are experts in this field. That gives you further peace of mind that your identity is being watched by experienced professionals.